In This article

Undoubtedly, you’re feeling the impact of inflation on your personal and professional life. The cost of everything seems to be rising — people need to make more than before just to keep the status quo.

And higher costs for individuals mean higher costs for businesses. The cost of ingredients at restaurants is rising, prices of clothing items at retail stores is skyrocketing, and the gas pump has most people cringing as they fill up.

So how do you deal with inflation for your business?

The gist: What you need to know

Here’s a summary of what this article will cover:

- The major areas where operators are feeling the pinch of inflation and changing consumer spending habits, rising operating costs, and increases in labor costs, just to name a few.

- Some areas that operators can focus on to tackle the impacts of inflation include revisiting your budget, using technology to make more informed business decisions, focusing on customer loyalty, reviewing pricing strategies, renegotiating your business contracts, and more.

- Want details on strategies for tackling inflation? Read on.

How did we get where we are? Inflation history

You’ve heard it time and time again — and I’m about to make it just one more time.

Higher costs of living and inflation have always come in waves, but the current pinch is largely a result of 2020.

COVID-19 had impacts across global supply chains, leading to shortages and increased production costs for many goods.

Another issue was a surge in consumer demand, largely fueled by government stimulus packages that were meant to keep people afloat as jobs were lost. This outpaced supply, pushing prices higher.

Despite the fact that the everyday impacts of the pandemic are diminishing, it seems that the pinch around prices is still dealing with the factors that happened in 2020 to drive prices this high.

And sadly, it doesn’t seem like the prices are going down anytime soon. While the YoY inflation rate in the United States went from 4.1% in May 2023 to 3.4% in April 2024, it’s still inflation. Prices have yet to start coming down.

What are some of the major areas where operators are feeling inflation?

Some pain points with inflation and operating costs are a universal experience, no matter what industry you are working on. Before we get industry-specific, let’s dive into the areas where the pinch is more obvious for most business owners and operators.

1. Changing consumer spending habits

One major thing most business owners and operators have in common, despite industry? As inflation drives up the prices of everything, consumers are becoming more price-sensitive, holding onto their wallets a little tighter.

Simply put, people are hesitant to spend with the cost of living being so high. Consumers are becoming more and more price sensitive, whether that’s when they’re buying a new pair of jeans, doing their weekly shopping, or anything in between.

These challenges require convenience stores to carefully balance pricing strategies, cost management, and customer service to navigate the pressures of inflation effectively.

2. Rising operating costs

The costs of keeping the building in your name and lights on are only going up (isn’t everything?).

Business owners are increasingly challenged by rising operational costs, which strain their financial resources and are a major threat to profitability — especially in industries where profit margins are already razor thin.

Rising operating costs is a bit of a buzzword, but it encompasses a ton of areas of your business, including:

- Rising wages

- Higher prices for materials

- Increased energy expenses

- Increased rent

However, that list isn’t expansive — there are a ton more areas of your business that can be impacted by rising operating costs. How exciting!

As a result, businesses have to get strategic to balance the costs. This can be done in a few ways:

- Implementing technology that helps to keep your eyes on shrink, smart scheduling, and more.

- Optimizing supply chains where you can. Maybe you place bulk orders with friendly stores in the area, investing in energy-efficient technologies, and

- Leveraging automation to reduce labor costs. This has become a tricky one — self checkouts have seen an increase in theft, and shoppers get frustrated if there are no humans to help. You need to strike a good balance.

- Passing some costs onto consumers through price adjustments. This can be extremely tricky while maintaining customer loyalty because customers can see through feeling like your costs are being passed onto them.

3. Labor costs

While labor costs are technically one of the rising operating costs, it’s important to call out on its own, especially considering labor is one of the top expenses for all industries. It’s especially hard considering the labor shortages, forcing people to offer more money as a salary to keep talent, which contributes to overall higher costs of operations. It’s a cycle.

You’re likely sick of hearing about the pandemic, but the impacts that COVID-19 had on the rising labor costs cannot be undersold. It was one of the hugest driving forces of the labor industry that operators face today. The COVID-19 pandemic accelerated a labor shortage that many industries were on the brink of facing, prompting many workers to reassess their career paths, retire early, or demand better working conditions, leading to a tighter labor market in these industries.

Additionally, inflation has increased the cost of living, prompting workers in retail and restaurants to look into other industries where they have the potential to make more (just to keep their standard of living the same). Government policies, such as minimum wage hikes in various regions, also contribute to the upward pressure on wages. The combination of these elements creates a challenging environment for retail and restaurant businesses as they strive to manage expenses while ensuring their workforce is adequately compensated.

Inflation for QSRs: how are they being impacted?

QSRs are feeling the same general pain points as above, but there are some areas specific to quick service restaurants.

1. Food costs

People see the food costs skyrocketing first-hand with their trips to the grocery store, so it’s no surprise that food costs getting higher is a huge area of concern for restaurant owners. As the prices of raw ingredients is rising, restaurants have to pay more for ingredients. This affects everything from basic staples like grains and vegetables to specialty items like seafood and meat.

And how are restaurants accommodating that food costs increase? By increasing their menu prices.

This means that people are unable to go out to eat due to higher prices, meaning restaurants risk losing customers. It’s a tough decision — stomach the rising food costs without changing prices, causing a smaller profit margin on each dish, or raise the price so your profit margins stay the same but risk losing customers?

Want to see how you can save up to 25% on food waste? See what DTiQ can save you at our food calculator here.

2. Labor Expenses

We talked about labor as a general rising expense, but there’s reason to think this is even more prominent in the restaurant industry.

Why? Let’s look at the west coast. In California, it was recently passed that fast food workers should be making a $20-an-hour minimum wage for their work. Similarly to food costs, this puts operators in a tricky spot. Do they cut down on staff and potentially compromise the guest experience due to fewer people doing more? Or do they increase their labor dollars and minimize their profit margins even further?

Inflation for retailers: how are they being impacted?

Retail stores are also facing significant challenges due to inflation. Here are three to four key areas where these struggles are most evident:

1. Increase in cost of goods

The cost of anything and everything in retail (from clothes to tools and everything in between) is going up for the retailers to source, which means it’s going to get more expensive for consumers.

It can also cause people to choose to simply not buy. Cost is a huge issue for consumers — if the price outweighs the value of the item, you’re going to lose

2. Inventory shortages

Inventory is short across nearly all retail industries. People trying to renovate their homes are waiting months, if not years, for supplies, for example. And naturally, since there are fewer items available, costs go up.

These shortages have been made significantly worse by manufacturing delays and transportation bottlenecks, leading to longer lead times. As a result, businesses are struggling to meet customer demand, which can impact sales and customer satisfaction.

3. Price sensitivity

Consumers are more sensitive to costs right now — and rightfully so. As wages struggle to keep up with rising living expenses, households are becoming increasingly budget-conscious, scrutinizing every purchase under a new lens.

This heightened sensitivity means that even the smallest price increases can have a large impact on consumer behavior. People are changing their spending patterns to more budget-friendly choices, like popping the generic products in their cart instead of the brand-name options or cutting down on the “fun money” in the budget. Businesses must navigate this environment carefully to keep people deeming the purchases offered as “valuable enough to justify”. Operators have to balance the need to manage their rising costs with the necessity of maintaining customer loyalty and satisfaction.

Inflation for C-stores: how are they being impacted?

C-stores sit in an interesting middle ground here — given the food service side that some of them have, they will face the inflation areas unique to QSRs, but they also have a retail aspect (as well as an entire operation outside, if they are also a gas station).

Here are some areas C-stores and gas stations have to be concerned about unique to them.

1. Cost of gasoline/fuel

The cost of gasoline can be a huge issue for C-stores and gas stations, especially since according to GasBuddy, the average net margin for fuel stations can be as little as one to two percent on gas purchases.

“Selling gas isn’t generally very profitable. Gas stations make very little revenue on fuel. Most of their revenue comes from items sold within their convenience stores,” Nicole Peterson from GasBuddy.com shared in an interview.

However, gas/fuel is the bread and butter for convenience stores that are also a gas station. Not having gas isn’t an option — how do they pivot to keep profits when they lose so much money on a main product?

2. Supply chain distribution

This is hardly unique to convenience stores, but it is a huge issue for businesses across industries. But when you consider how many different product lines convenience stores hold (liquor, food, and some even have clothing and home care items), the supply chain impacts C-stores in numerous markets they sell.

The issues in the supply chain have also led to higher costs since it’s harder to get said products. This includes everything from food and beverages to everyday essentials. The rising prices of these items mean that convenience stores either absorb the costs, reducing their profit margins or pass them on to consumers, which can lead to decreased sales.

Additionally, disruptions in the supply chain can result in stock shortages, leading to inconsistent inventory and potentially losing customers to competitors who can maintain better stock levels.

3. Rising labor costs

Wages are rising as the cost of living increases and there is greater competition for workers. Convenience stores, which often operate with a small staff, are finding it difficult to attract and retain employees without offering higher wages and better benefits. This puts additional financial pressure on the stores.

Increased labor costs can also reduce the funds available for other operational needs, further straining the business.

How do business owners tackle inflation?

There is no one-size-fits-all to tackling inflation at businesses. Strategies that are good for a convenience store may not be right for a retail operation, and what you’re doing for retail stores may not translate for restaurants.

All that to say — you need to evaluate your methods for tackling inflation individually at your store and with the lens of your industry.

But we can share some general areas to look at and how to tackle those.

1. Optimize your operation efficiently

Streamlining supply chains involves identifying and eliminating inefficiencies in the procurement and delivery process. This could mean consolidating shipments, using just-in-time inventory systems to reduce holding costs, or working closely with suppliers to improve lead times. Investing in technology, such as automation and AI, can enhance productivity by reducing manual labor and errors. For example, automated inventory management systems can help maintain optimal stock levels and reduce the risk of overstocking or stock-outs. Additionally, regular process reviews and adopting lean management principles can further eliminate waste and improve overall efficiency.

2. Use technology

You’ve seen all the ways that technology can improve your personal lives — get those same benefits in your professional life as well.

The right technology can help you tackle inflation in a ton of different ways, including:

- Reducing shrink: Shrink is essentially burnt money. Using intelligent video or loss prevention technology to keep an eye on shrink ensures you have more money in your pockets, instead of other people’s

- Smarter scheduling: Having technology that allows you to review your busy and not-so-busy times makes it easier to schedule strategically, ensuring you are getting the most from your labor dollars

- Audits into performance: Are you struggling with incomplete deliveries? Store cleanliness? Unlock more insight into your areas of concern with audits, giving you insights right into your inbox.

3. Renegotiate your contracts

Renegotiating contracts with suppliers can help secure more favorable terms and pricing. This might involve committing to longer-term contracts in exchange for price stability or bulk purchasing agreements that offer discounts. Building strong relationships with multiple suppliers can also provide leverage to negotiate better deals and reduce dependency on a single source. Diversifying suppliers geographically can help mitigate risks associated with regional disruptions or price hikes. Regularly reviewing supplier performance and market conditions can ensure that businesses are always getting the best possible terms.

4. Adjust your pricing strategies

Changing your pricing strategies is not as simple as raising your prices to put the cost of inflation on your customers. Adjusting pricing strategically is essential to manage inflation without alienating customers. This can look like:

- Creating sales that benefit both your business and the customer

- Using loyalty programs to offer rewards that can go towards purchases, helping shoppers feel valued

5. Focus on keeping your customers happy and loyal

Focusing on customer retention involves providing exceptional customer service to create a loyal customer base that is less sensitive to price increases. Enhancing loyalty programs with rewards, discounts, or exclusive offers can encourage repeat business. Engaging with customers through personalized marketing, such as targeted email campaigns or personalized product recommendations, helps build strong relationships. Soliciting feedback and responding promptly to customer concerns can also improve satisfaction and loyalty. Loyal customers are more likely to remain with a business despite price increases if they perceive added value and excellent service.

6. Budget, budget, budget

It’s time to look at your books and check them twice! Reviewing your budget in a regular and ongoing pattern is key to staying on top of inflation. Instead of paying bills and never reviewing, you need to see where bills are rising and where most of your cash is going. This also gives you a good idea of where you can try to or afford to cut down.

Tackle inflation today

The latest wave of inflation has people struggling to adjust, but it’s important to remember that it’s just that — a wave.

What is important now is doing what you can to weather the storm.

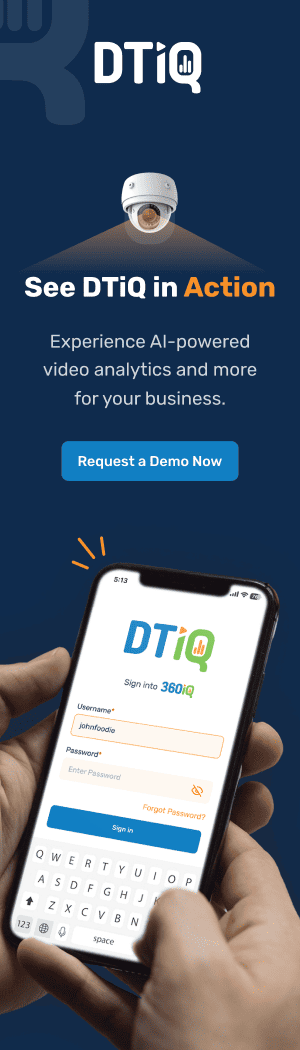

Let DTiQ help you battle inflation

Want to see how DTiQ’s technology can help you battle inflation? Our intelligent video and loss prevention solutions help you:

- Keep an eye on loss

- Manage staff scheduling with ease and data around busy ours

- Pull actionable insights from your data, helping you make more informed business decisions

- Stop fraud and shrink sooner, resulting in less loss

- And more!

Schedule a demo today to see what DTiQ can do for you.